Check Before Choosing an AEPS Service Provider

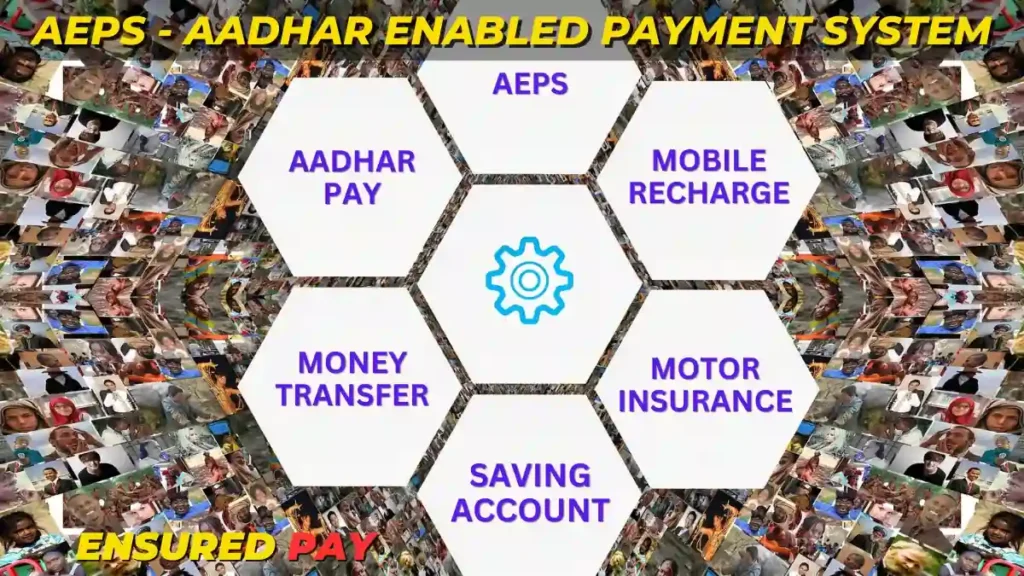

AEPS Provider: AEPS stands for Aadhaar Enabled Payment System, which is a digital payment service that allows customers to access their bank accounts using their Aadhaar number and biometric authentication.

AEPS enables customers to perform basic banking transactions such as cash withdrawal, balance inquiry, fund transfer, and mini statement without the need for a debit card, PIN, or internet connection.

How do I choose the best AEPS provider?

AEPS is a convenient and secure way to make payments, especially for rural and underbanked customers who may not have access to other modes of digital payment.

However, not all AEPS service providers are the same.

There are several factors that customers should consider before choosing a best AEPS service provider in India.

Here are some of the most important:

Service quality: Customers should look for an AEPS service provider that offers fast, reliable, and hassle-free service.

The provider should have a wide network of agents or merchants who can facilitate AEPS transactions.

The provider should also have a robust system that can handle high volumes of transactions without any glitches or errors.

The provider should also offer customer support and grievance redressal mechanisms in the event of any issues or complaints.

Security: Customers should ensure that the AEPS service provider they choose follows the highest standards of security and data protection.

The provider should comply with the guidelines and regulations issued by the Reserve Bank of India (RBI), the Unique Identification Authority of India (UIDAI), and the National Payments Corporation of India (NPCI).

The provider should also use encryption and authentication technologies to safeguard the customer’s Aadhaar number and biometric data from any unauthorized access or misuse.

Fees and charges: Customers should compare the fees and charges levied by different AEPS service providers before selecting one.

The fees and charges may vary depending on the type and amount of the transaction, the agent or merchant commission, and the service provider’s margin.

Customers should opt for an AEPS provider that offers transparent and reasonable fees and charges without any hidden or extra costs.

Features and benefits: Customers should also look for an AEPS provider that offers additional features and benefits that can enhance their experience and convenience.

For example, some AEPS service providers may offer cashback, rewards, discounts, or loyalty programmes to their customers.

Some AEPS service providers may also offer other value-added services such as bill payments, recharges, ticket bookings, insurance, loans, etc. Customers should choose an AEPS provider that meets their needs and preferences.

Finding the best AEPS provider in India can be a challenging task, but by following this ultimate checklist, customers can make an informed and smart decision.

By choosing the right AEPS service provider, customers can enjoy the benefits of digital payments without compromising their security or convenience.

Ensured pay : Choose a service provider based on convenience

Multi-language support

Some AEPS service providers may support multiple languages such as Hindi, English, Tamil, Telugu, etc. to cater to the diverse needs of customers across India.

QR code scanning

Some AEPS service providers may allow customers to scan a QR code displayed by the agent or merchant to initiate an AEPS transaction without entering the Aadhaar number manually.

Offline mode

Some AEPS service providers may enable customers to perform AEPS transactions even when there is no internet connectivity by using SMS or USSD codes.

Biometric device integration

Some AEPS service providers may integrate with various biometric devices such as fingerprint scanners, iris scanners, etc. to ensure accurate and secure authentication of customers.

Cash deposit

Some AEPS providers may allow customers to deposit cash into their bank accounts using their Aadhaar number and biometric authentication.

Micro ATM

Some AEPS providers may provide micro ATM devices to their agents or merchants that can perform all the functions of a regular ATM such as cash withdrawal, balance inquiry, fund transfer, etc.

E-KYC

Some AEPS providers may enable customers to complete their KYC (Know Your Customer) verification using their Aadhaar number and biometric authentication.

Aadhaar Pay

Some AEPS providers may offer an Aadhaar Pay service that allows customers to make payments to merchants using their Aadhaar number and biometric authentication without any card or mobile phone.

Aadhaar Seeding

Some AEPS providers may help customers link their Aadhaar number with their bank accounts and other services such as LPG, PAN, etc.

Aadhaar Update

Some AEPS providers may assist customers to update their Aadhaar details, such as address, mobile number, email, etc., using their biometric authentication.

Aadhaar Enrollment

Some AEPS providers may facilitate customers enrollment for an Aadhaar card if they do not have one by capturing their biometric and demographic data.

Aadhaar Printing

Aadhaar Printing: Some AEPS providers may provide customers with a printed copy of their Aadhaar card or e-Aadhaar letter using their Aadhaar number and biometric authentication.

As you can see from the above examples, all of them are related to the Aadhaar Card or AEPS (Aadhaar Enabled Payment Services), which are convenient and secure ways of accessing your bank account using your biometric authentication. However, if you want to avail of more benefits and features, you can also opt for an all-in-one service provider that can offer you not only AEPS but also other value-added services such as bill payments, recharges, ticket bookings, insurance, loans, etc

Ensured Pay is a best aeps portal that provides you various services like money transfer, utility bill payments, multi recharge, finance services, PAN card, online savings account, and car and bike insurance, apart from the AEPS service.

You can use Ensured Pay to access multiple bank accounts, make transfers, accept online payments, check balances, and more.

You can also become a retailer or distributor with Ensured Pay and earn commissions on every transaction.

Get Paid for Your Work Every Time – Try the Ensured Pay App Today!

Start Your Dream Business in Minutes – Register Now!